Default Risk for US Firms Up More Than 7% in Last Year

- Credit quality for US-based firms continues to deteriorate, with overall probability of default rising 7.4% on a year-over-year basis.

- Probability of default currently highest for US-based firms.

- EU-based firms entering economic strife in strongest position.

US Oil & Gas

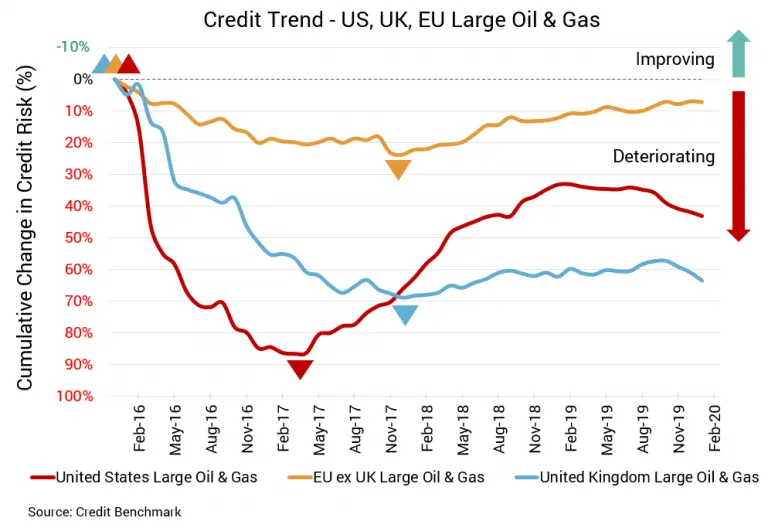

The credit situation for large US oil & gas firms keeps getting worse. Credit quality for this sector has declined by 1% on a month-over-month basis and 7.4% on a year-over-year basis. The majority of this deterioration has happened in the last six months, with credit quality down 6.7% over that period. The average probability of default has increased over the last year, currently at 44.5 basis points, compared to 44.1 basis points the month prior and 41.4 basis points at the same point last year. The current Credit Benchmark Consensus (CBC) rating remains at bbb- and has not changed over the last year.

UK Oil & Gas

Compared to the US, the credit situation is only marginally better for UK large oil & gas firms. Credit quality for this sector has declined by 1.7% month-over-month and by 0.8% over the last year. This has been driven by an increase in average probability of default over the last year, albeit at a slower pace than the US. Average probability of default for UK large oil & gas firms is currently 40.8 basis points, compared to 40.1 basis points the month prior and 40.5 basis points at the same point last year. The current Credit Benchmark Consensus (CBC) rating is bbb- and has not changed over the last year.

EU Oil & Gas

For EU-based oil & gas firms, there continues to be little month-over-month change in credit quality. After last month’s minor improvement of 0.4%, this month showed deterioration of 0.2%. On a year-over-year basis, credit quality improved by 4.4%. Average probability of default has held largely flat over the last month, increasing from 22.2 basis points to 22.3 basis points on a monthly basis and down from 23.3 basis points a year ago. The current Credit Benchmark Consensus (CBC) rating is bbb and has not changed over the last year.

.

About The Credit Benchmark Monthly Oil & Gas Aggregate

This monthly index reflects the aggregate credit risk for large US, UK, and EU firms in the oil & gas sector. It provides the average probability of default for oil & gas firms over time to illustrate the impact of industry trends on credit risk. A rising probability of default indicates worsening credit risk; a decreasing probability of default indicates improving credit risk. The Credit Benchmark Consensus (CBC) Rating is a 21-category scale explicitly linked to probability of default estimates sourced from major financial institutions. The letter grades range from aaa to d.

To download the March 2020 Oil & Gas Aggregate PDF, click here.