US corporate debt is notoriously overrepresented in the ‘BBB’ rating category, and investors fear that economic pressure could topple these bonds Jenga-style into high-yield status. Enter coronavirus – the rapid spread of the disease has caused a sharp shock to global markets and a swathe of industries are vulnerable to take a profit hit as the economy faces a ‘slowbalisation’ effect.

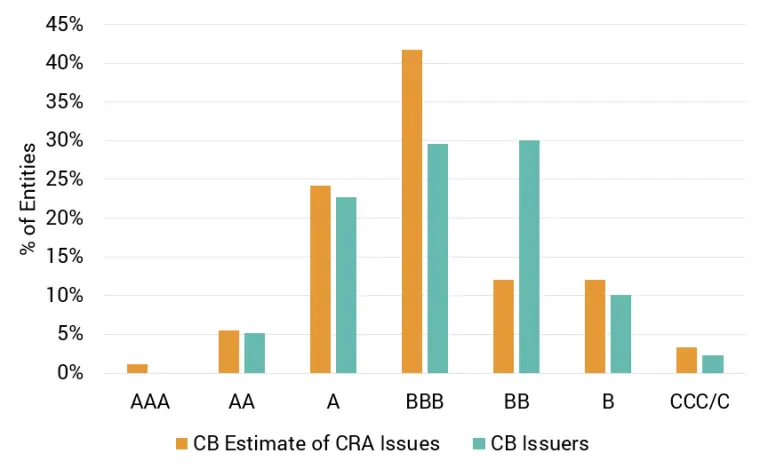

But if the tower of BBB debt is to fall, where will the pieces land? The latest credit risk snapshot from Credit Benchmark, which captures probability of default (PD) estimates from the world’s leading financial institutions to produce a consensus-based credit rating, provides some clues that are not yet showing up in traditional credit ratings agency (CRA) forecasts. The data illustrates the spread in credit quality of US Corporate Borrowers, comparative to the major CRAs’ rating spread of US Corporate Bonds. Whereas the estimates from the traditional CRAs show a sharp drop off from BBB to the high-yield category of BB (gold bars in chart below), the Credit Benchmark consensus estimates demonstrate roughly equal weighting between BBB and BB borrowers before tailing into the B and C categories (green bars in chart below).

This means many corporate bond issuers whose bonds are currently rated BBB by the traditional CRAs have already been downgraded to high-yield status in the Credit Benchmark dataset. This is important because the Credit Benchmark dataset captures a larger universe and more frequently updated consensus estimates. The data in the chart below is updated monthly, representing the most current view of credit risk estimates from the world’s largest lending institutions.

Credit Risk Distribution of US Corporate Bonds vs US Corporate Borrowers

The data suggests a current disparity of 15% between bond ratings from the CRAs vs the Credit Benchmark consensus estimate when it comes to high-yield distribution, suggesting that over a third of BBB rated bonds are highly vulnerable to a downgrade into non-investment territory. The Credit Benchmark BBB/BB/B spread of borrowers may preemptively reflect the future distribution of US Corporate Bonds in the event that a catalyst such as coronavirus topples the status quo.

This research has been referenced in the Wall Street Journal article, “Investment-Grade Bonds Could Turn to Junk Amid Global Rout”, which can be read here, plus in the Bloomberg article, “For Battered Junk Bond Market An Old Risk Grows Louder Every Day”, which can be read here.