The crucial upcoming spring season of home buying and selling may be under threat from the economic downturn posed by the spread of COVID-19. Though low interest rates pose a strong incentive for mortgage borrowers, the economic uncertainty may prove too strong a deterrent for some buyers. Both buyers and sellers are also likely to be wary of traditional house viewing practices on account of health and hygiene concerns.

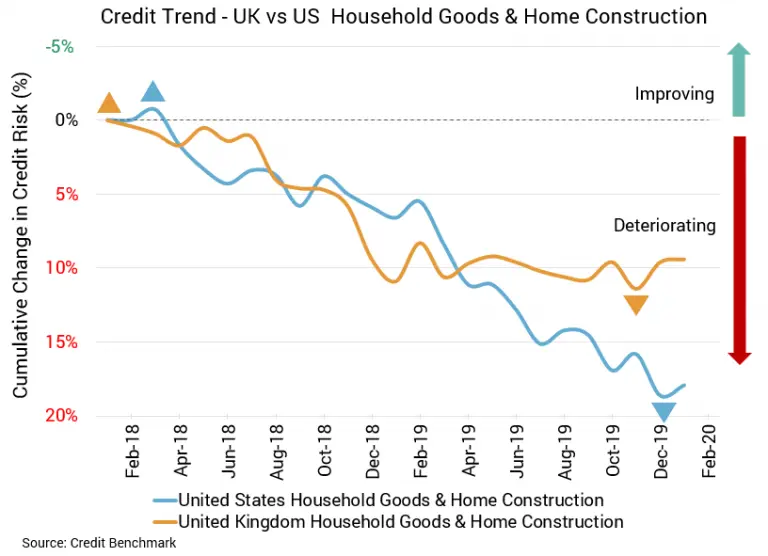

This month saw incremental credit quality improvement for both US and UK Household Goods & Home Construction companies, however the US companies have experienced longer-term credit deterioration. UK companies have fared more evenly in recent months after earlier credit deterioration. It is likely that both groups of companies will be detrimentally affected as COVID-19 puts a dampener on the coming months’ housing sector prospects.

Default Risk for US Firms Increases Almost 11% in Last Year

- Default risk for US housing sector firms up 11% year-over-year, despite incremental monthly improvement.

- UK housing sector credit risk holds steady with bb+ rating.

US Household Goods and Home Construction Firms

The relentless weakening in credit quality in the US housing sector took a month off, with probability of default for companies in the US Household Goods and Home Construction sector improving 0.6% on a monthly basis. Despite this one-month reprieve, overall credit risk in the sector is up 10.6% on a year-over-year basis. The average probability of default for the aggregate is currently 54.5 basis points, compared to 54.8 basis points the month prior and 49.2 basis points at the same point last year. The current Credit Benchmark Consensus (CBC) rating for this aggregate has not changed from the prior month nor from the same point last year and remains at bb+.

UK Household Goods and Home Construction Firms

Credit quality for the UK housing sector is largely stable. There was slight improvement of 0.2% from the prior month and a marginally larger improvement of 1.3% from the same point last year. Average probability of default for this aggregate has not changed greatly over the last year. It’s now 54.1 basis points, compared to 54.3 basis points the prior month and 54.9 basis points at the same point last year. The Credit Benchmark Consensus (CBC) rating for this aggregate has held steady at bb+ over the last year.

To download the March 2020 Housing Aggregate PDF, click here.

About Credit Benchmark Monthly Housing Aggregate

This monthly index reflects the aggregate credit risk for US and UK firms in the household goods and home construction sectors. It illustrates the probability of default for a variety of companies in the home construction space as well as firms that would benefit from increased home building and buying. Worsening credit risk means a greater probability of default; improving credit risk means a reduced probability of default. The Credit Benchmark Consensus (CBC) Rating is a 21-category scale explicitly linked to probability of default estimates sourced from major financial institutions. The letter grades range from aaa to d.

About Credit Benchmark

Credit Benchmark brings together internal credit risk views from 40+ of the world’s leading financial institutions. The contributions are anonymized, aggregated, and published in the form of entity-level consensus ratings and aggregate analytics to provide an independent, real-world perspective of risk. Consensus ratings are available for 50,000+ financials, corporate, funds, and sovereign entities globally across emerging and developed markets, and 75% of the entities covered are otherwise unrated.