General Retailers are struggling to get a break, with the long-standing challenge of getting consumers through the door now exacerbated by COVID-19 related worries. If the virus continues to spread, shoppers will be more likely to avoid busy high streets and stores and businesses will in turn suffer. This is not to mention the impact a potential economic recession would have on consumer sentiment and spending.

Not all retailers are created equal though, and some sub-sectors may see growth during these difficult times, namely in consumer staples like food groceries, cleaning products and healthcare items, which have already seen a rise amidst concerns of COVID-19 related shortages.

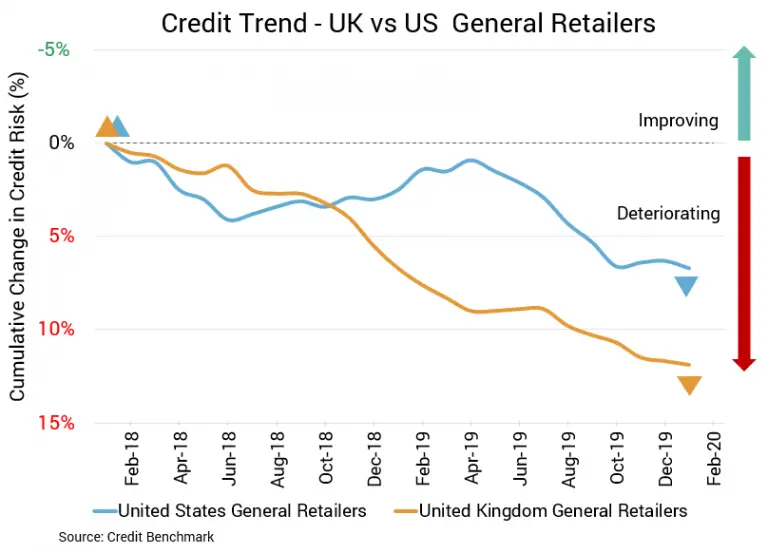

Default Risk for UK Retailers Up Almost 5% in Last Year

- Credit quality for both US- and UK-based firms continues to deteriorate, but probability of default is higher for UK-based firms.

- Credit Benchmark Consensus (CBC) rating sits at bb+ for both aggregates.

US General Retailers

The credit slide for US general retail firms has stabilized in recent months with only a small deterioration of 0.4% since last month and little change in either direction for the past four months. On a year-over-year basis, however, credit quality deteriorated by 4.1%. In terms of average probability of default for the group, the current position is 51.1 basis points, compared to 50.9 basis points in the prior month and 49.1 basis points at the same point last year. The current Credit Benchmark Consensus (CBC) rating for this aggregate is bb+, unchanged from last month and this time last year

UK General Retailers

The credit situation for UK general retail firms keeps worsening. The recent month-over-month change in credit quality is a modest deterioration of 0.2%, but the year-over-year picture is more concerning, deteriorating by 4.9%. The average probably of default for this aggregate is currently 71.1 basis points, compared to 71 basis points in the prior month and an increase from 67.8 basis points at the same point last year. The Credit Benchmark Consensus (CBC) rating for this aggregate is bb+, and as with the US aggregate, this is unchanged from the prior month as well as the same point last year. However, the UK group sits closer to tipping into the bb CBC band if the credit trend continues to deteriorate.

About Credit Benchmark Monthly Retail Industry Aggregate

This monthly index reflects the aggregate credit risk for US and UK General Retailers. It illustrates the average probability of default for companies in the sector to achieve a comprehensive view of how sector risk will be impacted by trends in the retail industry. A rising probability of default indicates worsening credit risk; a decreasing probability of default indicates improving credit risk. The Credit Benchmark Consensus (CBC) Rating is a 21-category scale explicitly linked to probability of default estimates sourced from major financial institutions. The letter grades range from aaa to d.

To download the March 2020 Retail Aggregate PDF, click here.