Coronavirus impact on the global economy

The rapid spread of the new strain of coronavirus, now officially known as COVID-19, has made an immediate impact on the global economy. China’s stock market saw an 8% drop after the recent Lunar New Year, the biggest single day drop since 2015. While the world’s supply chains have already been impacted from prolonged trade wars between China and the US, the added disruption to trade and travel routes will reverberate globally.

Credit risk: travel industry

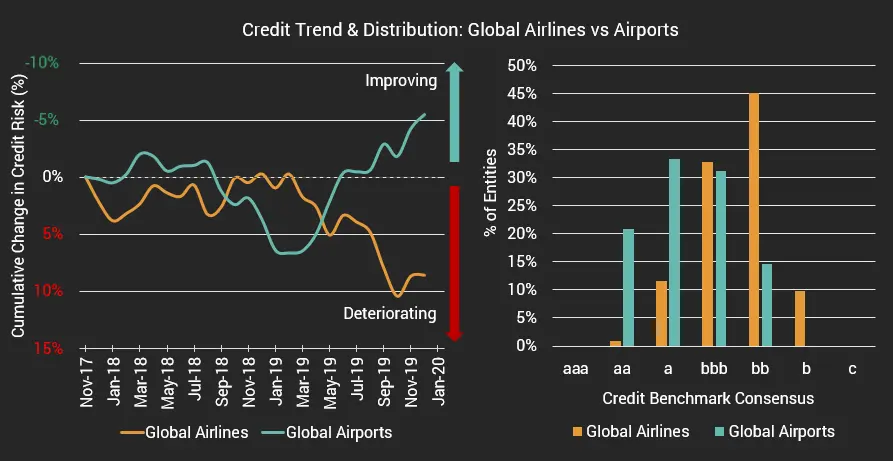

The worst affected industry in this crisis will undoubtedly be the travel sector. Many major airlines have suspended flights to and from mainland China and world leaders have urged their citizens to avoid travel to the region, stoking fears from neighbouring Asian nations that they in turn will feel the contagion effect of a tourism fallout. Air China, China Eastern Airlines and China Southern Airlines have collectively seen a stock value drop of 20% since early January when the threat of the virus began to be known internationally. The airline industry is highly competitive and has already been rocked by recent high profile setbacks (e.g. last year’s grounding of the Boeing 737 Max) – these have had a significant impact on sector credit quality. Consensus credit data, sourced from leading financial institutions, shows that Global Airlines have deteriorated in credit quality by 8% since the start of 2019.

Credit trend & distribution: global airlines vs airports

Passenger numbers to the Asia-Pacific region were forecasted to grow by 1,180m by 2024*; double the volume of the next fastest growing region (Europe). But while suspended flights and a reduction in airline passengers will have a clear and immediate effect on the collective fortunes of global airlines, an often overlooked business impact is to the airports that service them. Airports globally have become profitable, high quality shopping precincts, servicing a large and – until now – steadily growing captive customer base.

Credit divergence between airlines and airports

According to Credit Benchmark’s credit risk analytics, Global Airports showed credit deterioration in late 2018, but since the turning point in February 2019, credit quality has improved by 12%. Depending on the spread of COVID-19, the credit divergence between Global Airlines and Global Airports may have run its course. Currently, Global Airports demonstrate higher overall credit quality, with 85% of the companies represented rated as investment grade, compared to only 45% of the airlines analysed; so Airports are well positioned to handle a temporary downturn. But if the coronavirus impact is prolonged, Global Airports may find their previously robust business model under strain.

Download the PDF – Coronavirus Contagion Effect on Credit Quality for Global Airline Industry