The US-China trade talks this month could be critical to the global economic outlook for the next few years. One Chinese proposal is for a sustained reduction in its trade surplus though a combination of monetary and fiscal expansion, in addition to targeted trade incentives.

China’s debt levels have been a persistent concern, doubling over the past decade. But GDP has grown in tandem, helped by the large shadow banking sector.

The recent crackdown on shadow banks and the easing of reserve requirements for traditional banks gives some assurance that the monetary base is being monitored and is under some form of control; but further expansion to satisfy the US demands over the trade surplus will require careful handling.

Continued GDP growth is the best route to increased imports, but this does not have to be all consumer-led; investment spending – public and private – can be used as initial drivers provided they lead to employment growth.

However, slowing population growth is a potential brake on this; China’s recent infrastructure investment boom has been an attempt to draw in rural workers but this may not be enough to satisfy the ambitious plans for the next decade.

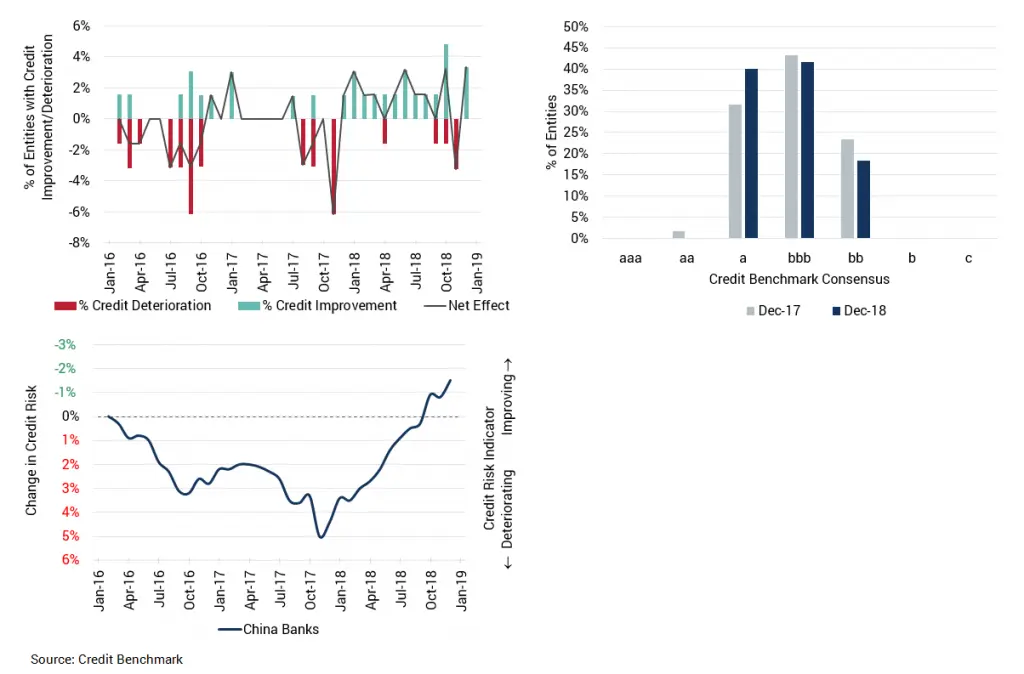

The charts below are based on credit data for 64 mainstream Chinese banks.

The majority of Chinese banks in this sample are investment grade, and the proportion in category a has increased in the past 12 months. Average credit deteriorated until late 2017 but it has been steadily improving since then. The balance of improvements vs. deterioration has been volatile but generally positive.

This suggests that Chinese banks are increasingly well-placed to handle an expansion in their balance sheets – they key will be for this to be channelled into sectors that will help the trade position.