The new leaders of the 9th and 15th largest economies in the world face major challenges in 2019, but both are riding waves of popular support and cautious optimism in financial markets.

Brazil

Brazil’s stock market has risen more than 10% (in USD) so far this year, and the 10-year Government bond yield has dropped from over 11% in Q3 2018 to about 9%. After sluggish 1% growth in 2018, the 2019 forecast is for more than 2%.

Staunchly conservative President Bolsonaro, who was stabbed on the campaign trail last year and is currently in hospital, is the latest outspoken and potentially divisive politician on the global stage. He wants to tackle Brazil’s infamously generous public pension system with reforms which include raising the retirement age. His controversial vision and business-friendly agenda would present a decisive economic and social break from the country’s left-wing past and potential to displace Mexico as the USA’s closest ally in the region.

Mexico

Mexico’s stock market is up a more modest 6% since the start of the year, and bond yields have backed up slightly from 3.7% to 4.3%. US foreign and trade policies dominate the outlook, but President Obrador and Finance Minister Marquez are taking active steps to adapt to the new economic order.

Mexico is now discussing tax cuts for the Mexican states in the border areas, less co-operation with the DEA, and a push for Foreign Investment (including, ironically, from the US).

With a growing immigration problem of their own – mainly from Venezuela – the new administration are hoping to set an example to their Central and Southern American neighbours on how to tackle the underlying causes of migration. This involves ambitious plans for cultural changes to turn the tide of drug-related violence and related corruption.

Credit turning points ahead?

Brazil has some immediate and high-impact policy decision-making on the horizon. Mexico, on the other hand, is preparing to attempt a shift in its economic and social structure.

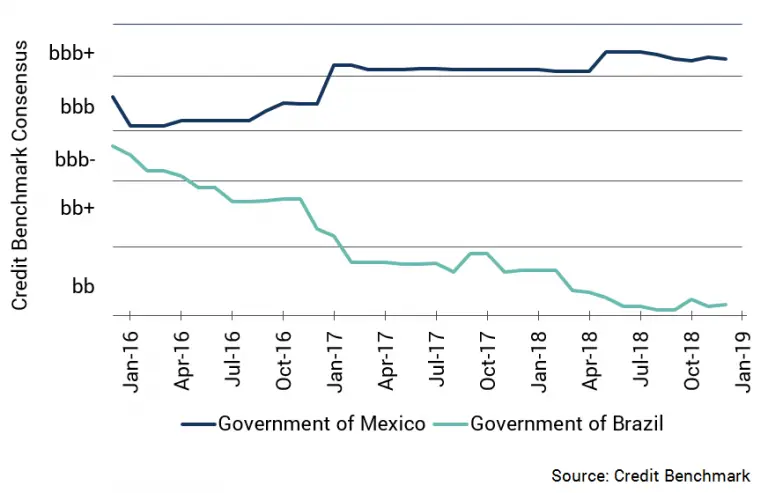

The chart shows that, in sovereign risk terms, major financial institutions have been increasingly positive on Mexico and increasingly negative on Brazil over the past three years. Mexico now sits comfortably at bbb+ in the Investment Grade zone; Brazil has slumped towards bb. With new political leaders and shifting alliances in the Americas, there may be some credit turning points ahead.