The Italian financial position has been a major driver of market volatility, but credit data suggests that banks are turning more positive. Moody’s now has Italian Sovereign debt at one notch above junk, with a stable outlook; S&P has so far kept it at BBB, but with a negative outlook.

The main concern is the new government’s plan for a public deficit of 2.4% of GDP (against the previous government’s target of 0.8%). Italy currently has EUR 2.5 trillion (132% of GDP) in outstanding Government debt, with EUR250bn due to be issued in 2019. Reflecting this risk, Italian 10-year bonds trade 300 Bps above the Eurozone average.

This difference is unsustainable in a common currency bloc, and coalition member parties have even suggested launching a parallel currency to help in tax collection. But if this became a widely-accepted reality then Italy would at the very least need to leave the Euro, re-issue the Lira, and would be at risk of a major credit downgrade.

If the Italian Sovereign rating did drop into junk territory, the ECB would withdraw funding from Italian banks, who need to refinance EUR 18bn in 2019. Banks who cannot maintain their liquidity coverage ratio would be merged or wound up under an EU-wide bail-in, because recapitalisation is increasingly difficult under EU rules.

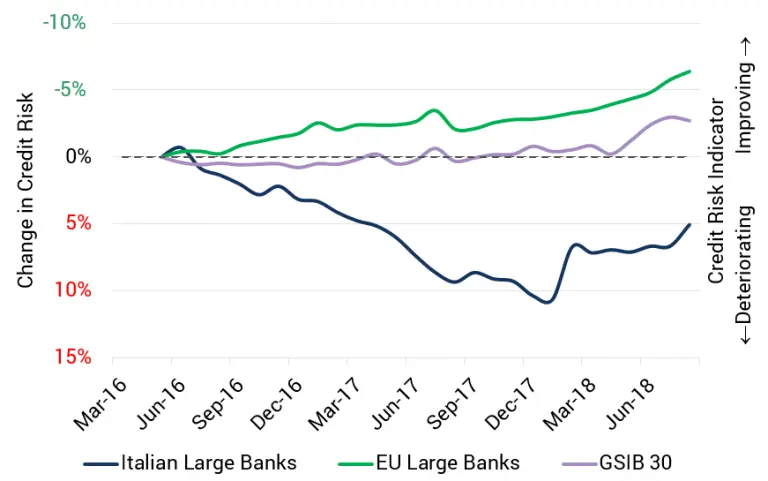

But despite these apparently intractable problems, there has been a modest improvement in the global bank credit consensus for Italian bank counterparties. Italy are not the only Eurozone member who regularly breaches EU fiscal rules, and both the corporate and household sectors are potential sources of significant amounts of alternative funding. The optimistic global bank view suggests that they expect the EU to manage Italy’s “too-big-to-fail” problem with temporary waivers and possible rule changes.

The chart shows the credit improvement in Italian banks compared with the broader EU and the Globally Systemically Important Banks (GSIBs). EU bank credit risk has improved by 5% since early 2016. Large Italian banks deteriorated by more than 10% until the end of 2107 but have improved by 5% since the beginning of this year.