For the past decade, Sovereign bond yields have been held down by Central Bank funding facilities. But with interest rates now rising as various forms of QE are phased out, a new set of potential anomalies has appeared.

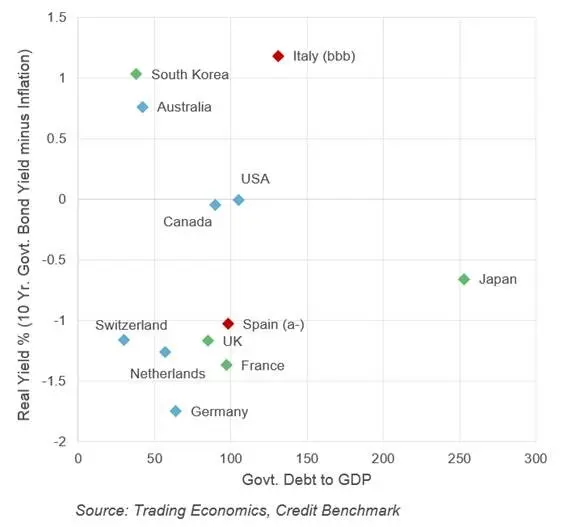

The chart plots real yields for 10-year Government Bonds against the Ratio of Government Debt to GDP, for 12 major developed economies including the G7 countries. These are colour coded by consensus credit rating: blue shows aaa, green are aa categories. Spain and Italy are plotted in red and their consensus ratings (a- and bbb) are labelled.

The cluster of economies in the lower left quadrant are those with Government Debt to GDP ratios of less than 100%, and real yields of -1% or lower. These include three aaa countries (Switzerland, Netherlands and Germany), two aa countries (UK and France) as well as Spain at a-.

US and Canada – both aaa – share similar Government Debt ratios with these other countries; but their real yields are close to zero, reflecting the more aggressive interest rate policies in those two countries, with Canada typically following the US lead. US Sovereign bond yield levels are partly driven by concerns about the impact of fiscal expansion on debt, as well as the attendant inflation risks. If these concerns are overdone, then there is a possible anomaly compared with the lower left quadrant.

There are even more striking anomalies in the South Korea (aa-) and Australia (aaa) Sovereign bond markets, with both showing high real yields and low debt ratios. South Korean real yields may anticipate that a closer relationship with North Korea raises the risk of a one-off economic hit to the South Korean economy, in a milder version of that experienced by Germany after full unification in the 1990’s. Australia looks like an outlier, with its low debt and a consensus rating of aaa, but has real yields of close to 0.8% – the third highest of the 12.

One significant apparent outlier is Japan (aa-) with negative real yields and a seemingly staggering debt ratio of more than 250%. Against this, Japan has significant positive foreign exchange reserves and most of the Government’s bonds are held by the Central Bank. Inflation remains a minor risk, since it is a tempting route to reducing the real debt burden; but Japan is unlikely to risk the wrath of a large and aging population by deflating their savings. Japan’s Government debt is an intractable but apparently manageable problem.

This leaves Italy (bbb), with the highest real yield (more than +1%) and a debt ratio of 130% – high, but not unmanageable. The bond yield and the consensus credit rating reflect concerns about the new ruling coalition and the resulting scope for further debt growth. The main contrast is with Spain, which has lower debt (around 100%) and fewer immediate political challenges. But nervous investors in Italy are currently being offered a real yield differential of more than two percentage points vs. Spain, while the two countries are only two credit notches apart.

Previous research by Credit Benchmark (https://www.creditbenchmark.com/sovereign-bond-risk-management/) showed some evidence of mean-reversion in real Sovereign bond yields, with them moving into alignment with consensus credit ratings. As the “Great Normalisation” in interest rates gathers pace, it will be interesting to see if the same process unfolds.