In March we reported on the challenges facing UK Retailers.

Retail sales in May were unexpectedly good (possibly due to the Royal Wedding), but recent store closure announcements from Carpetright, Debenhams, House of Fraser and John Lewis show that traditional companies in this sector continue to suffer.

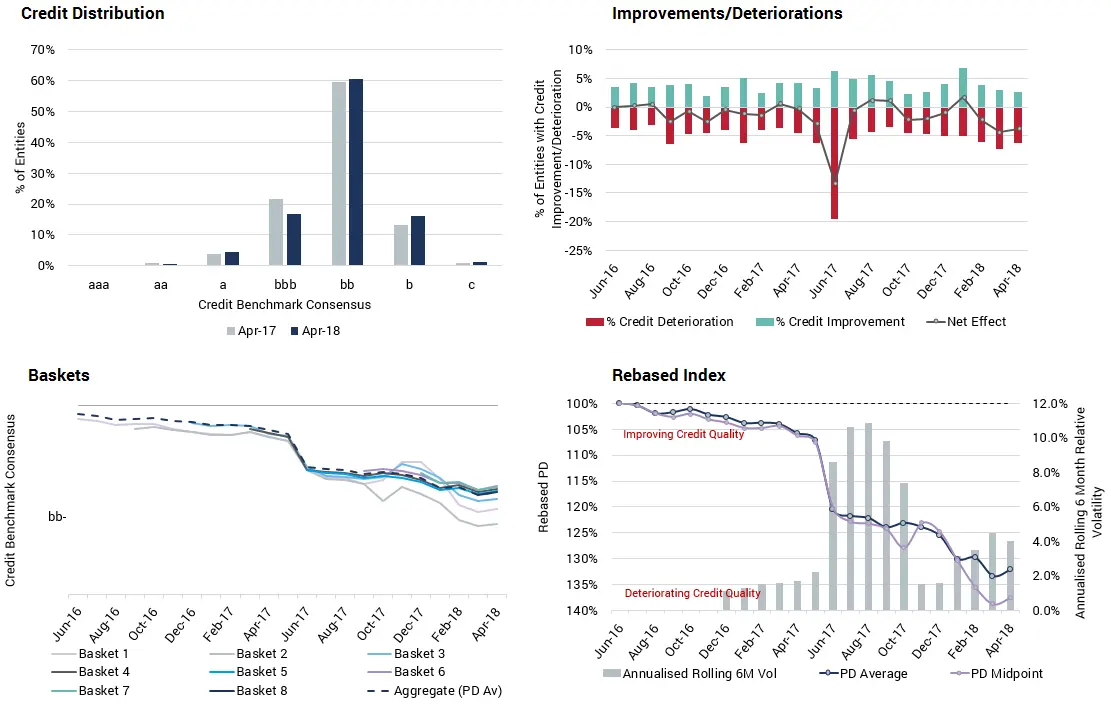

As can be seen in the charts below, more than 70% of the Credit Benchmark UK Retail universe is now classed as below Investment Grade, with a CBC of bb or worse.

Credit deteriorations have outnumbered improvements in most of the past 12 months, and the cumulative deterioration in credit quality has been around 35%.

But the most recent data appears to show a slight reduction in credit risk, although it also shows that banks have been rebalancing loan portfolios towards baskets of the higher quality borrowers in the sector.

This selection effect will be one reason for the apparent improvement in the aggregate trend, so it is probably too early to say that UK Retailers are close to a turning point. But Credit Benchmark will continue to monitor the sector and publish regular updates.