The IMF Regional Economic Outlook report from April 2018* discusses the recent increase in debt levels across Sub-Saharan African countries. This growth is partly in response to very favourable borrowing terms available to frontier markets in the current low interest rate / low credit spread environment. The issuance of foreign currency debt by these countries has reached record highs across the region; but many of these countries rely on public investment to drive growth.

The IMF report estimates that 40% of low-income Sub-Saharan African countries are in debt distress or assessed as being at high risk of debt distress. If US interest rates continue to rise as part of a wider normalisation in the cost of capital, the refinancing pressure on the indebted frontier countries will increase.

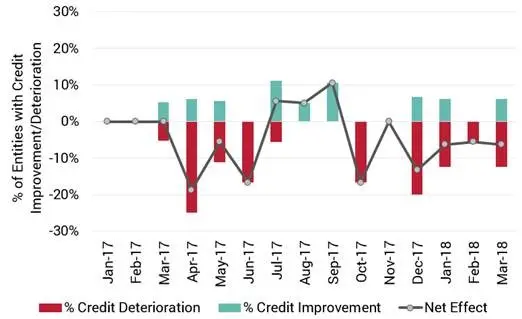

As the chart below shows, the increasing risk of debt distress has already affected the credit quality of Sub-Saharan African countries. This is based on bank-sourced estimates for 21 of the Sovereigns in the region, and plots the balance of sovereigns with improving vs deteriorating credit quality.

Currently it shows a sustained trend towards credit deterioration. Over the past 20 months, credit risk has increased for 10 countries and has improved for only 5.

* Regional Economic Outlook: Sub-Saharan Africa, World Economic and Financial Surveys, International Monetary Fund, Washington, DC April 2018, http://www.imf.org/en/Publications/REO/SSA/Issues/2018/04/30/sreo0518