Credit Benchmark has published the latest monthly credit consensus data (from March 2018), with 22 contributor banks. The set of bank-sourced credit views (CBCs*) has increased by 25%, and now covers almost 19,000 separate legal entities.

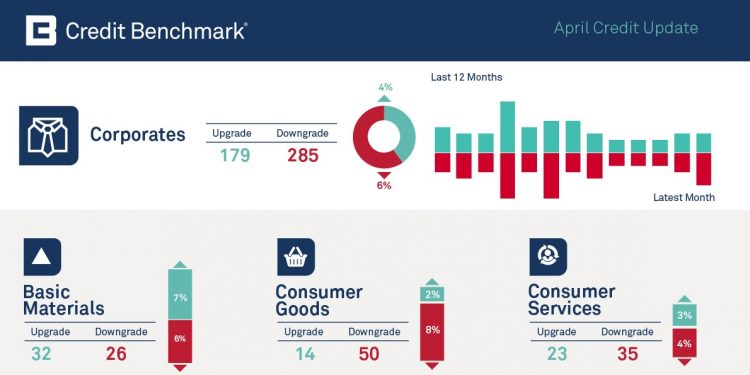

Monthly consensus upgrades and downgrades (including Funds):

Last month showed improvements across 326 obligors and deterioration across 237, with 37 moving by more than one notch.

Industries:

*Credit Benchmark Consensus (“CBC”): this is a 21-category alphanumeric scale based on bank-sourced one-year probability of default estimates. It is similar to the scale used by the main credit rating agencies, so that a CBC of bbb is approximately equivalent to BBB reported by S&P and Fitch, and Baa2 reported by Moody’s

Disclaimer: Credit Benchmark does not solicit any action based upon this report, which is not to be construed as an invitation to buy or sell any security or financial instrument. This report is not intended to provide personal investment advice and it does not take into account the investment objectives, financial situation and the particular needs of a particular person who may read this report.